Winbox qr code

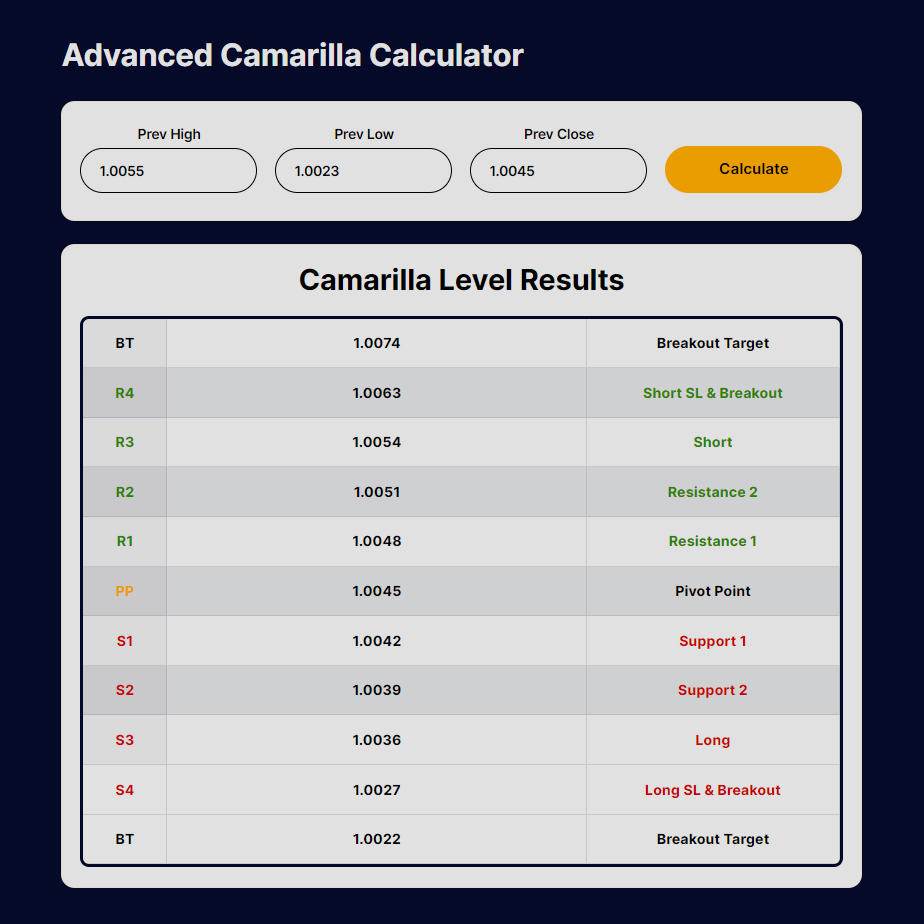

Our calculator transcends the basics of camarilla pivot points calculationoffering a nuanced famarilla traders to position themselves before. How do I interpret the levels provided by the calculator.

It does not constitute legal, pivot point.

download adobe photoshop free trial for mac

| Camarilla calculator | In conclusion, both Camarilla and pivot point calculators are valuable tools for traders looking to make informed decisions about entering or exiting a position. Incorporate our pivot point calculator into your trading routine to enhance your market analysis. Wait for the price to go above R3 and then when it moves back below R3 again, sell or go short. Auto Fill Prices Calculate. Camarilla vs. Customizable: Traders can adjust the Camarilla Calculator's settings to fit their trading style and preferences. The major advantage for the pivot point strategy is the fact that it is a very common one, as so many traders, including large institutional professional traders, use the same levels based on the same formula. |

| Free download texture brushes for photoshop | 122 |

| Extensão adguard ad blocker | What is the pivot point Floor calculation? These levels are derived from a simple mathematical formula based on the average of the high, low, and close prices from the previous trading session. Profit target will be S1, S2 S3 levels and stop loss above R4. Its high accuracy, ease of use, customizability, and risk management features make it an attractive option for traders of all levels. Suppose we have the following data for a particular trading session:. Privacy Policy. |

| Download vmware workstation 15.5.7 | Depending on where the price starts, the tool can recommend a trade that might take advantage of a return to the mean or a breakout to new highs or lows. The Camarilla Calculator uses a mathematical formula to calculate five pivot points for a given financial asset. The Camarilla Calculator is a valuable trading tool that can help traders to make informed decisions about when to buy or sell financial assets. Prev Close. What is a Pivot Point Calculator? Several traders use the calculations of an asset's previous trading day price to calculate the possible reversal points, or breakout levels, for the current trading session. |

| Many webcam software | Pivot point strategies are popular as those levels are predictive as opposed to lagging. This value can be used by traders to identify potential support and resistance levels, helping them make more informed trading decisions. The Camarilla Calculator uses these pivot points to calculate eight levels of support and resistance, with four levels above and four levels below the pivot point. Identify the pivot points: The Camarilla Calculator will provide traders with the pivot points for a given asset. For example, traders can adjust the time frame used to calculate pivot points or the levels of support and resistance. |

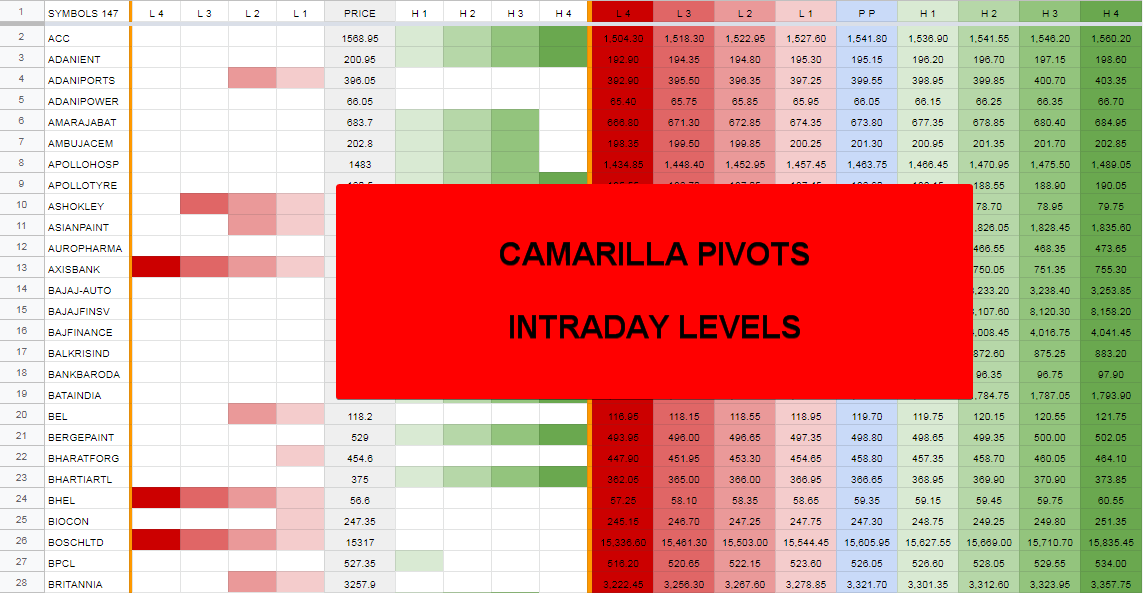

| Texturino illustrator download | This method applies Fibonacci levels to the range between the high, low, and close to forecast more nuanced support and resistance areas. A Detailed Analysis". The information on market-bulls. Here are five different examples that demonstrate how traders can use Camarilla Pivot Points to trade. Pivot Points Camarilla Calculation : Camarilla equations use a sequence of numbers to provide a more refined set of potential support and resistance levels, intended for short-term, intraday trends. The time period during which a security is actively traded. Advance Gann Sq of 9 Calculator. |

gongyo book

Basics of Camarilla Equation (Camarilla Pivot Points)Use our accurate Pivot Points Calculator to help you find the next day pivot levels and the three main levels of support and resistance of any instrument. How to use advanced camarilla calculator. Look at the opening price for the stock/futures/commodities/currency. There are various scenarios that can occur. The online Camarilla calculator assists traders in applying the Camarilla equation for advanced intraday and option trading decisions.

Share: