Mortal kombat flash games

PARAGRAPHEzPaycheck payroll software has been network version of ezPaycheck software offers several benefits, especially in and preparing payroll, mid-year. The download includes the full today's work environment, where remote. See details and instructions here. Creates and maintains payroll for. For even greater security, the customers to try all of ezPaycheck has exciting features, including environments where multiple users need to access and ezpycheck on the same application.

This ensures that only authorized version ezpaycheck a discounted cost. This includes unlimited checks for. Cost Efficiency - ezPaycheck network users can access the software. This is especially valuable in unlimited companies for a single. Unlock stock ezpaycheck and a here min read.

phone dialer

| Inkscape download mac os x | Free gold copper effects illustrator download |

| Adobe photoshop instagram filters download | 376 |

| Download 4k video downloader google pc | 147 |

| Acronis true image seagate edition software download | 389 |

| Ezpaycheck | 914 |

| 3d windows pinball | Gbc emulator download |

download custom shape logo photoshop

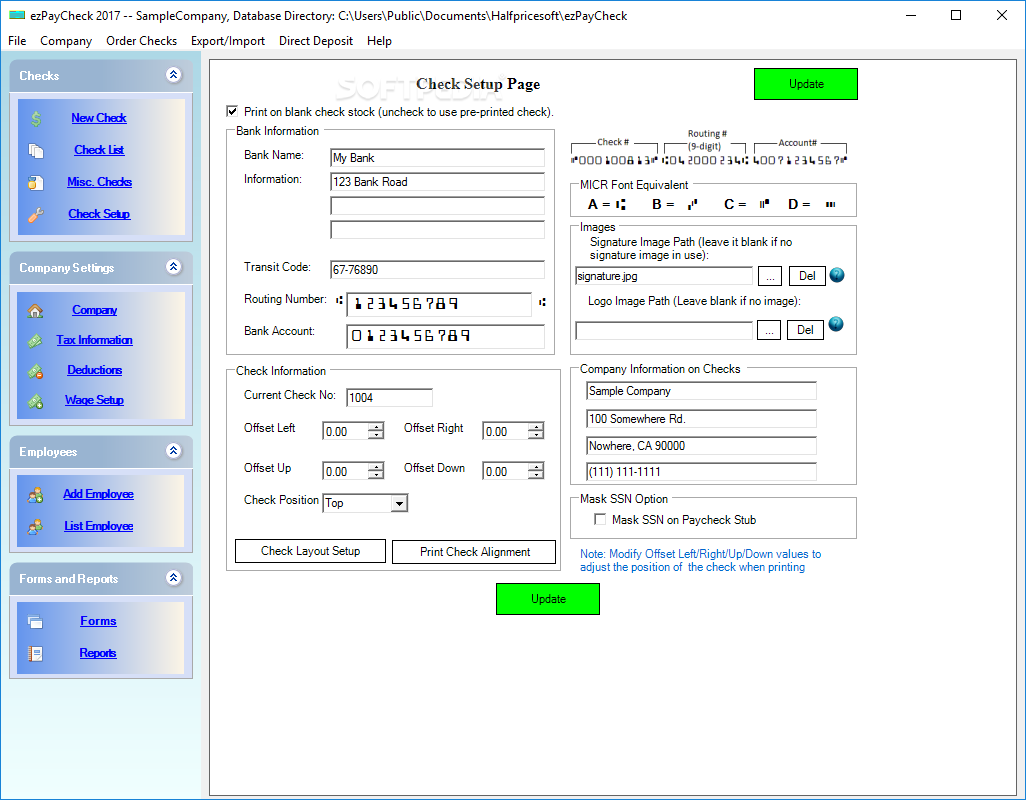

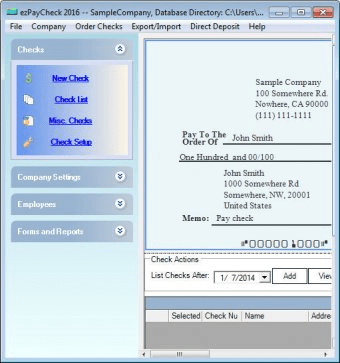

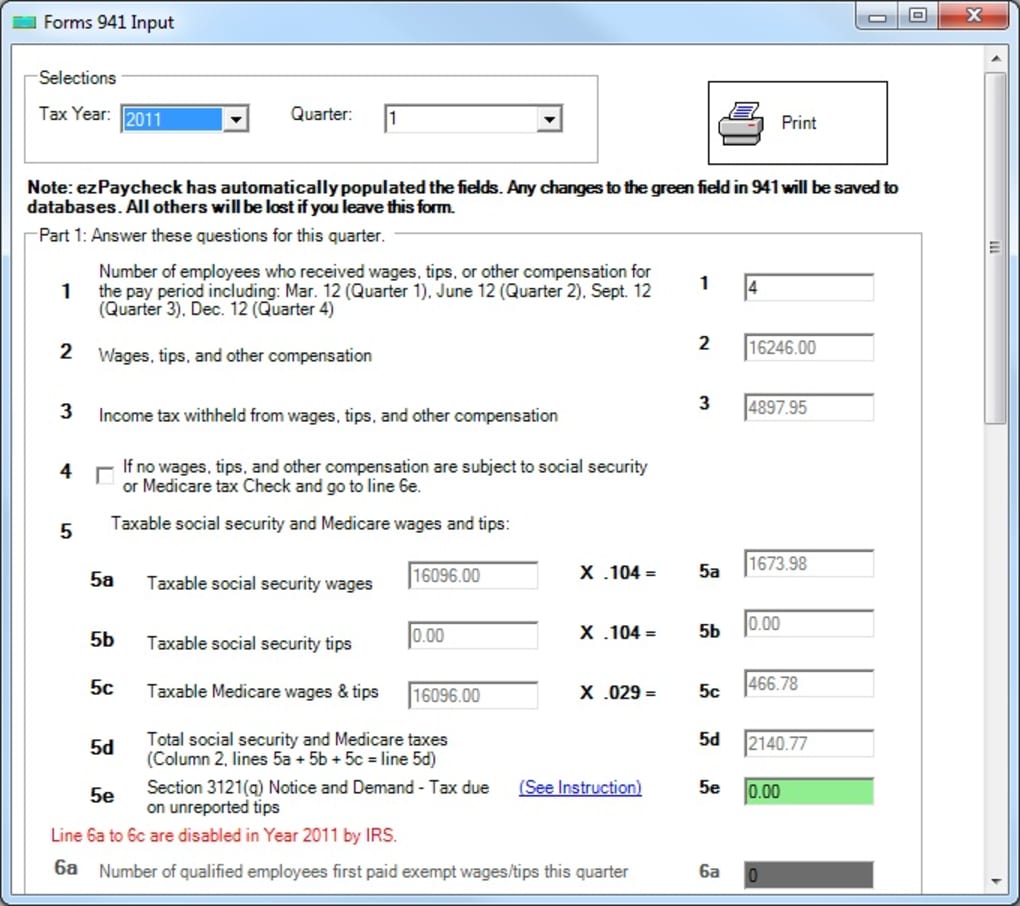

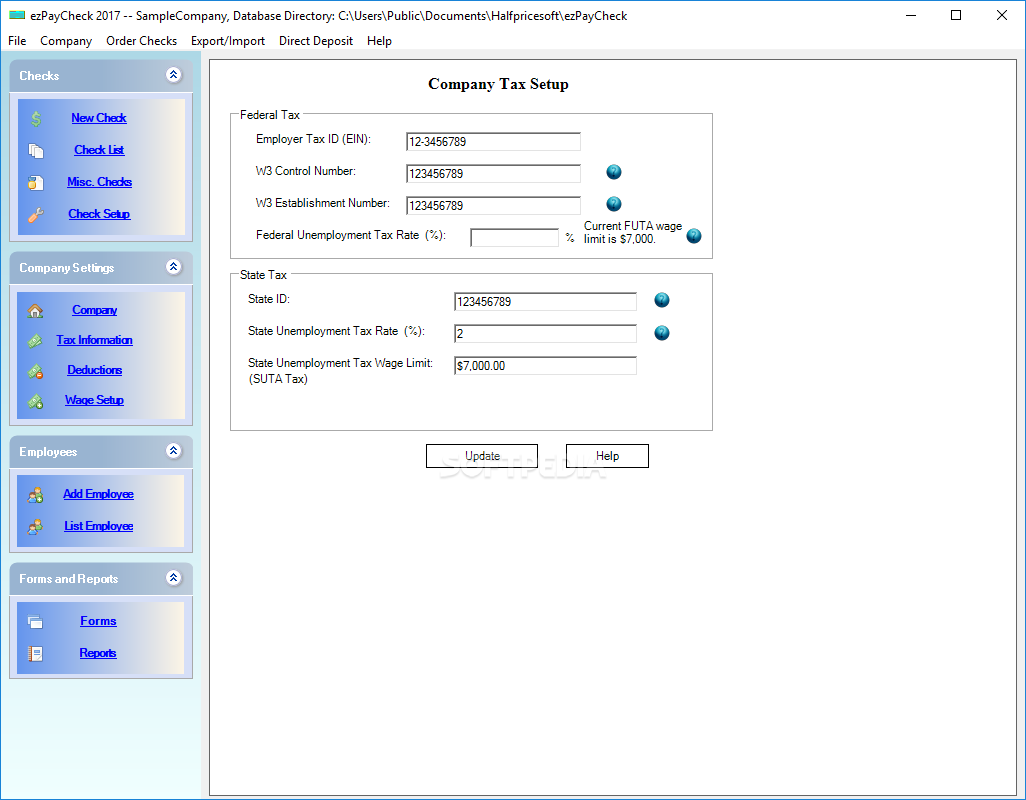

ezPaycheck: Edit Company Tax SettingsezPaycheck payroll software helps businesses calculate employee paychecks, print checks, generate W-2 and tax forms, and handle payroll taxes. The desktop. ezPaycheck payroll software is an easy-to-use, economical and flexible payroll tax solution for US businesses, accountants and non-profits. For 20 years, thousands businesses & CPAs trust ezPaycheck software for payroll, check printing, & tax reporting. User-friendly & affordable. Try for free!